It was doomed from the start.

The demise of Plenti may have come as a surprise to some, but it makes a lot of sense if you dig deeper. The multi-merchant rewards program has always struggled to find its place with consumers in the U.S.

Plenti seemed like a behemoth of a loyalty program. It allowed customers to collect points at many different retailers. They could then use those points at any other retailer under the Plenti umbrella.

But after losing many of its brand participants in the past six months, Monday’s announcement that the Plenti program will end on July 10th was simply ceremonial in nature. It served as the final nail in its coffin.

Plenti of High Hopes

I’ve written extensively about the program, including the compounded demise of Plenti, since the program launched in mid-2015. Initially, I saw high hopes and the promise of increased customer engagement and customer experience for participating brands.

Run by U.S. Loyalty, a division of American Express, Plenti launched with nine companies. By the end of 2016, it spanned 13 partners with 16 brands. This placed it in 71 percent of all U.S. households within a five-mile radius of at least two of the 30,000 retail locations participating in the program.

Things appeared encouraging for the Plenti program. Members brands included American Express, ExxonMobil, Macy’s, Rite Aid, AT&T, Nationwide, Hulu, Rite Aid, Enterprise Rent-A-Car, Expedia, and Chili’s Grill & Bar restaurants.

A Domino Effect and the Demise of Plenti

But, then things began to unravel in 2017 for Plenti as some participating brands exited the program. Like dominoes, once brands started leaving the program, the others started to fall off.

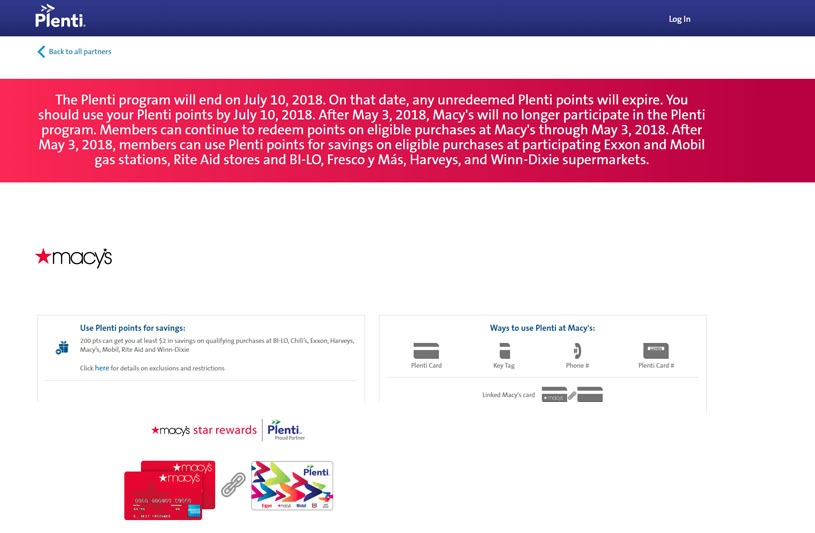

And the biggest domino was Macy’s when it launched its new Star Rewards loyalty program six months ago.

Although Macy’s didn’t officially leave Plenti until February, back in October many loyalty industry officials wondered why Macy’s would launch its own loyalty program as a member of Plenti.

It cast doubt over the coalition model’s impact. Then, AT&T exited the program in October. Two months later, American Express announced that its Plenti co-branded credit card would be discontinued. All accounts were to be canceled in February.

On Jan. 1, 2018, Direct Energy, Hulu, Nationwide, Enterprise, and Expedia also left the Plenti program. At that point, the writing of Plenti’s demise was inscribed in bold-faced letters on the wall. It was all over.

Hindsight is 20/20

Looking back, there were many signs that the coalition loyalty program wouldn’t work.

Over the past three years, I have spoken with several industry experts about Plenti. They have all echoed the same point: These types of programs have under-performed.

Instead of creating personalization, coalition loyalty programs have found it difficult to integrate into a brand experience beyond the surface level.

Coalition programs, like Plenti, engender loyalty, not to its partner brands, but to the coalition program itself. Industry experts added that coalition loyalty programs are not equipped to be differentiating for any one brand.

And other experts have told me that Plenti’s demise was due to an inability to create personal connections, personas, journeys, motivators, personalized offers, and targeted campaigns to drive behaviors that lead to desired business outcomes.

Our CEO Tom Caporaso says that coalition programs like Plenti struggle to create true brand loyalty.

“Coalition loyalty programs are appealing in theory. They seem like they will elevate a brand’s transaction levels. However, they aren’t efficient at creating actual loyalty,” Tom explains.

“A loyalty program has to be brand aligned and customer targeted. Macy’s realized that loyalty should be a brand’s differentiator. A coalition model like Plenti lacks consistent delivery on that brand promise because it’s a one-size-fits-all solution. The focus was always on Plenti and not the retailers. That’s why it made sense for them to drop out.”

Plenti members began exiting the program because of shifting priorities among some founding partners and changing competitive conditions in their respective industries.

Macy’s showed us something six months ago when it launched its Star Rewards loyalty program. An internal assessment and a rethinking of what customer loyalty means can make all the difference in the world.